Did you know that selecting a broker without research is like playing a game of chance?

Website: | |

Email: | |

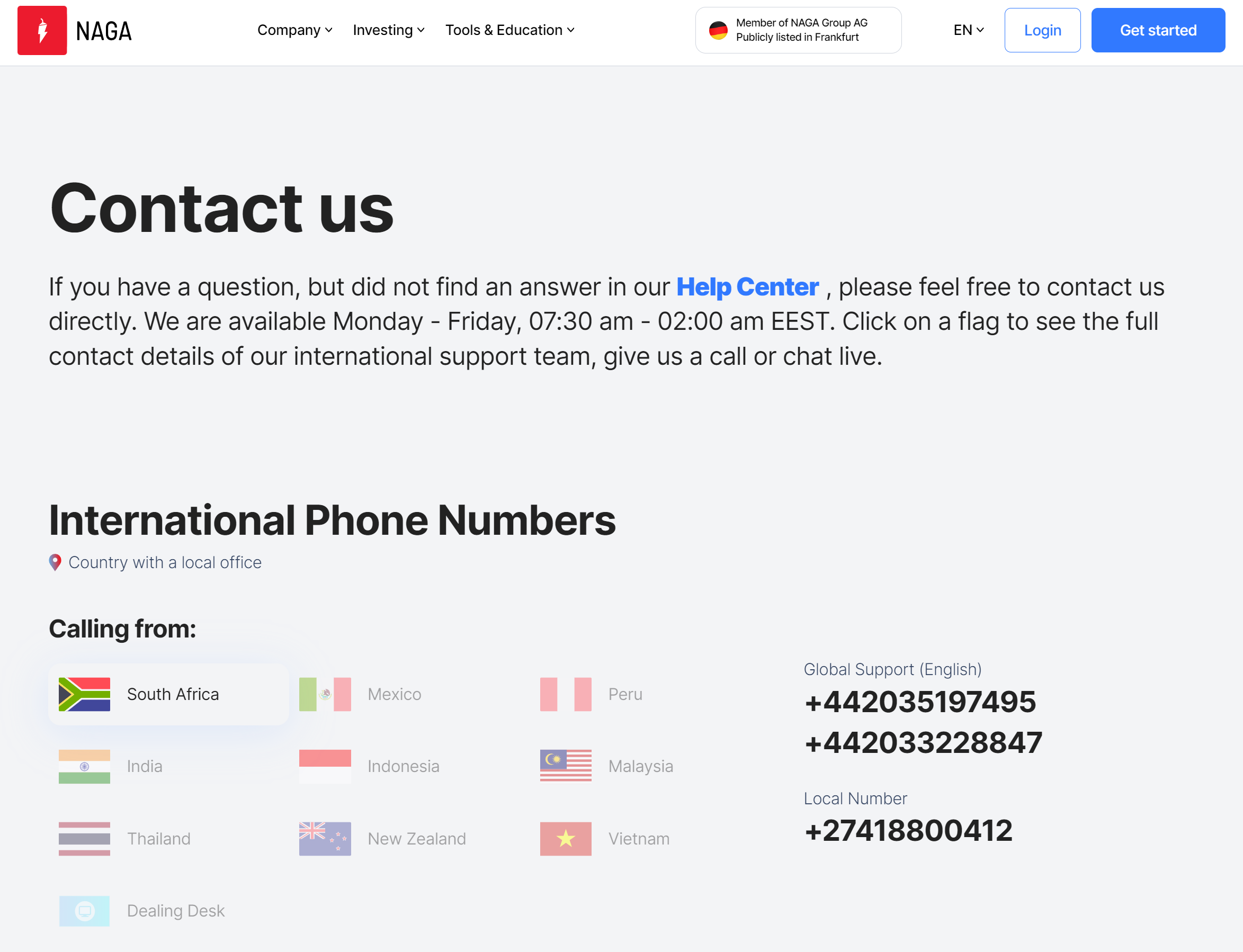

Telephone: | +442035197495 / +442033228847 |

Company Address: |

⚠️ SCAM ❔👀

➡️ Be prepared for Naga’s fascinating ratings!

Withholding Profits & Withdrawal Delays | ⭐⭐⭐⭐ |

Transparency | ⭐⭐⭐ |

Withdrawal Options & Terms | ⭐⭐⭐ |

Large Withdrawal Challenges | ⭐⭐⭐⭐ |

Trust in Services | ⭐⭐⭐ |

Support Department Response Time | ⭐⭐⭐ |

Fees & Charges Fairness | ⭐⭐ |

Investments involve risks and are not suitable for all investors.

🚫 We Recommend You Not to Trade at Naga Until You Have Read Our Full Review 🚫

Did you know that in Sanskrit, “Naga” translates to the mighty “Cobra Snake”? (But hey, let’s keep our fingers crossed and hope it refrains from giving us a personalized souvenir, shall we?). In fact, it symbolizes strength, wisdom, and the untamed spirit of adventure. But wait, there’s more! Brace yourselves for the heat. Naga is also the name of the hottest chili pepper in the world! It ignites the taste buds and fuels a fire within like no other.

Curious to know more about Naga? Keep reading!

➡️ A brokerage claiming to be a global force in CFDs and social trading. At Naga, they pride themselves on creating a vibrant online community where traders and investors can connect, learn, and even copy each other’s strategies. 🌶️

Is NAGA Scam or a Legit Platform?

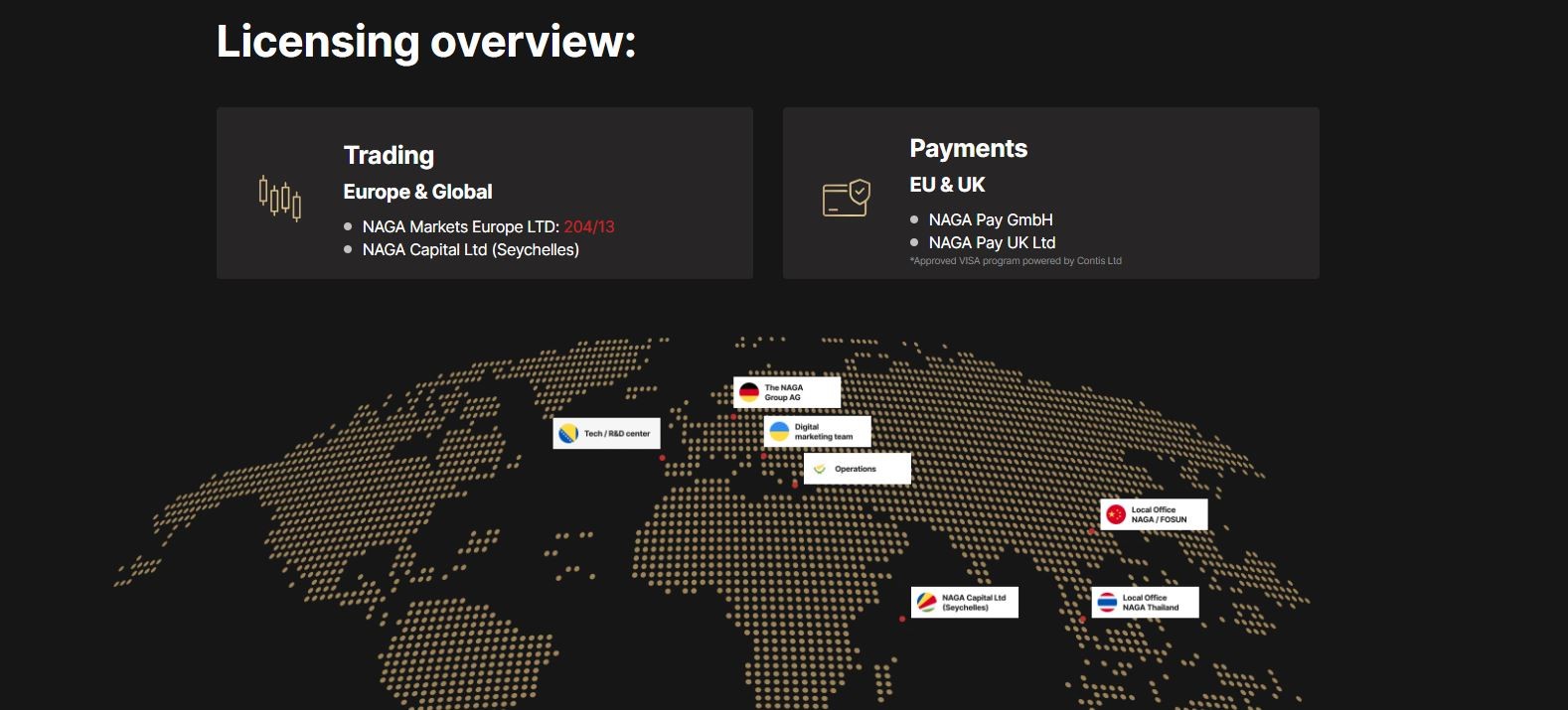

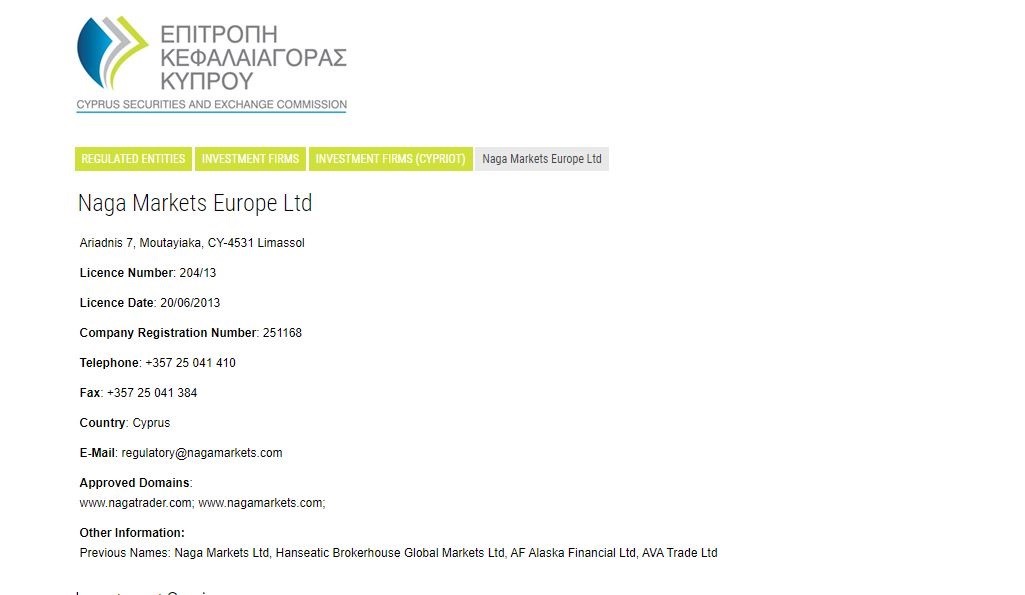

NAGA Markets Europe Ltd proudly flaunts its full authorization and regulation by the Cyprus Securities and Exchange Commission (CySEC). With license number 204/13 and a cross-border CySEC license for providing investment services, they appear to have all their regulatory ducks in a row. They claim to follow stringent rules like MiFID II, MiFIR, and the Cyprus Investment Services and Activities and Regulated Markets Law of 2017, demonstrating their commitment to compliance.

| ➦ Is the lack of more tier 1 regulators something that concerns you? ➡️ When a broker is regulated by multiple tier 1 authorities, it demonstrates a commitment to compliance and accountability, which can foster greater trust among traders. |

NAGA Capital Ltd is authorized and regulated by the Financial Services Authority (FSA) of Seychelles with license number: SD026. Why the Seychelles, anyway? Brokers turn to offshore licenses to evade trade leverage restrictions and enjoy more aggressive marketing freedom. A suspicious twist, indeed!

➟ Take the time to thoroughly examine the License and Regulation Information provided by Naga.

The NAGA Group AG is the holding company of NAGA Markets Europe Ltd, NAGA Technology GmbH, NAGA Global LLC, NAGA Pay, and NAGA Capital Ltd.

NAGA Global LLC is incorporated under the laws of St. Vincent and the Grenadines as a Limited Liability Company (1189 LLC 2021) and is an operating subsidiary within The NAGA Group.

From Hamburg, Germany, NAGA Group, a German fintech firm, lays claim to disrupting the investing landscape through its app and social network amalgamation, and according to the information provided, in 2017, the NAGA Group established itself by obtaining a spot on the esteemed Frankfurt Stock Exchange.

⚠️ Tracking their Performance Over Time ⚠️ 📈 On November 17, 2017, the NAGA’s Group price soared to its highest point at 14.02 EUR, whereas as of today (June 26, 2023), it is hovering around the vicinity of 1.60 EUR. 📉 How would you tap into that information?  |

Pros vs. Cons – Who Will Prevail?

Pros | Cons |

✅ More than 1000 tradable assets | ❌ Spreads are high for regular accounts, but fair and lower than 1 other account. |

✅ Offers real stocks | ❌ There is a standing commission of €0.99, with an additional commission of 5% if the profit of the copied trade exceeds. |

✅ Social Trading Opportunity | ❌ They charge swaps |

➦ Are Naga’s Platform Offerings Sufficient to Fulfill Your Requirements?

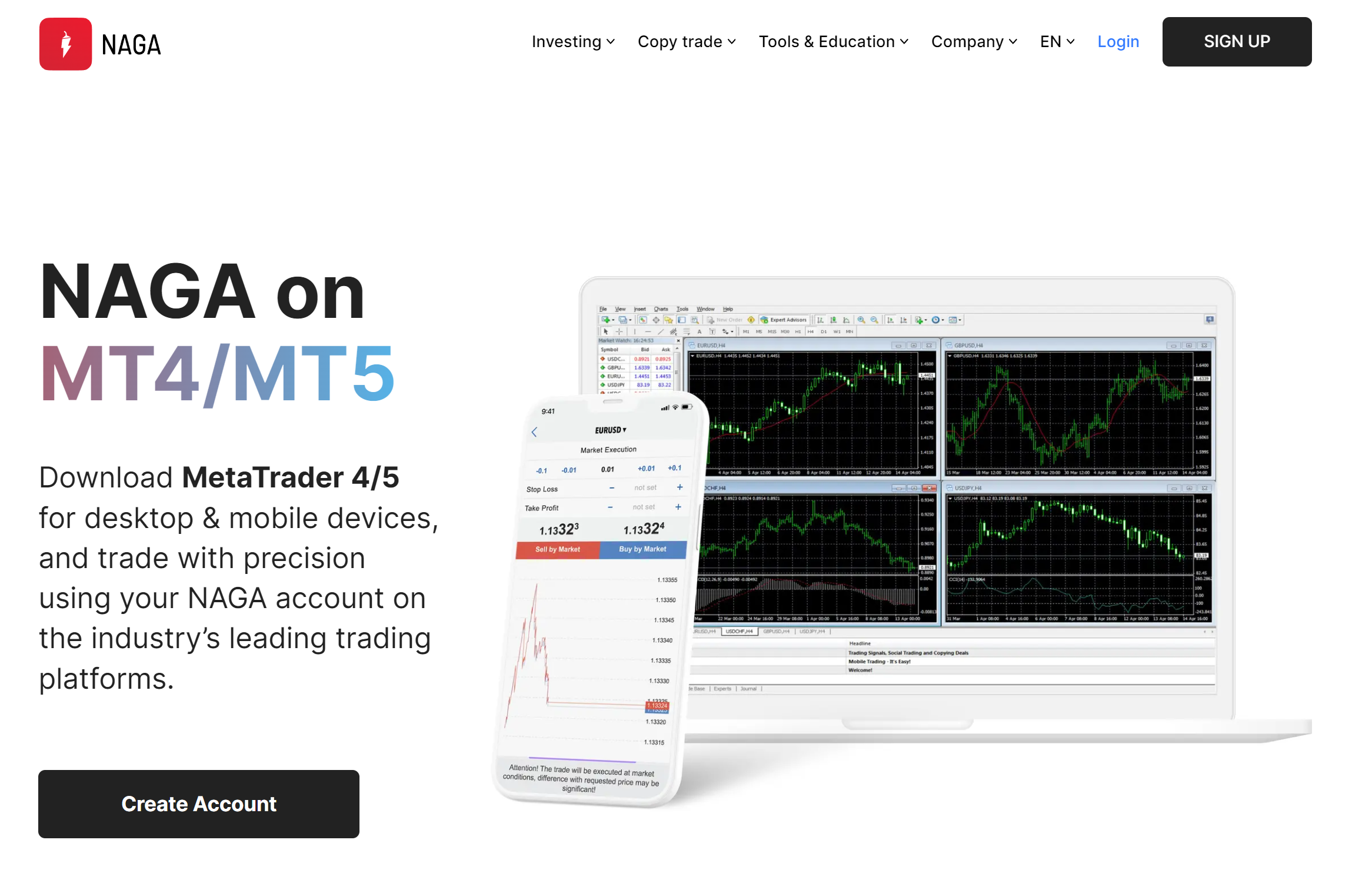

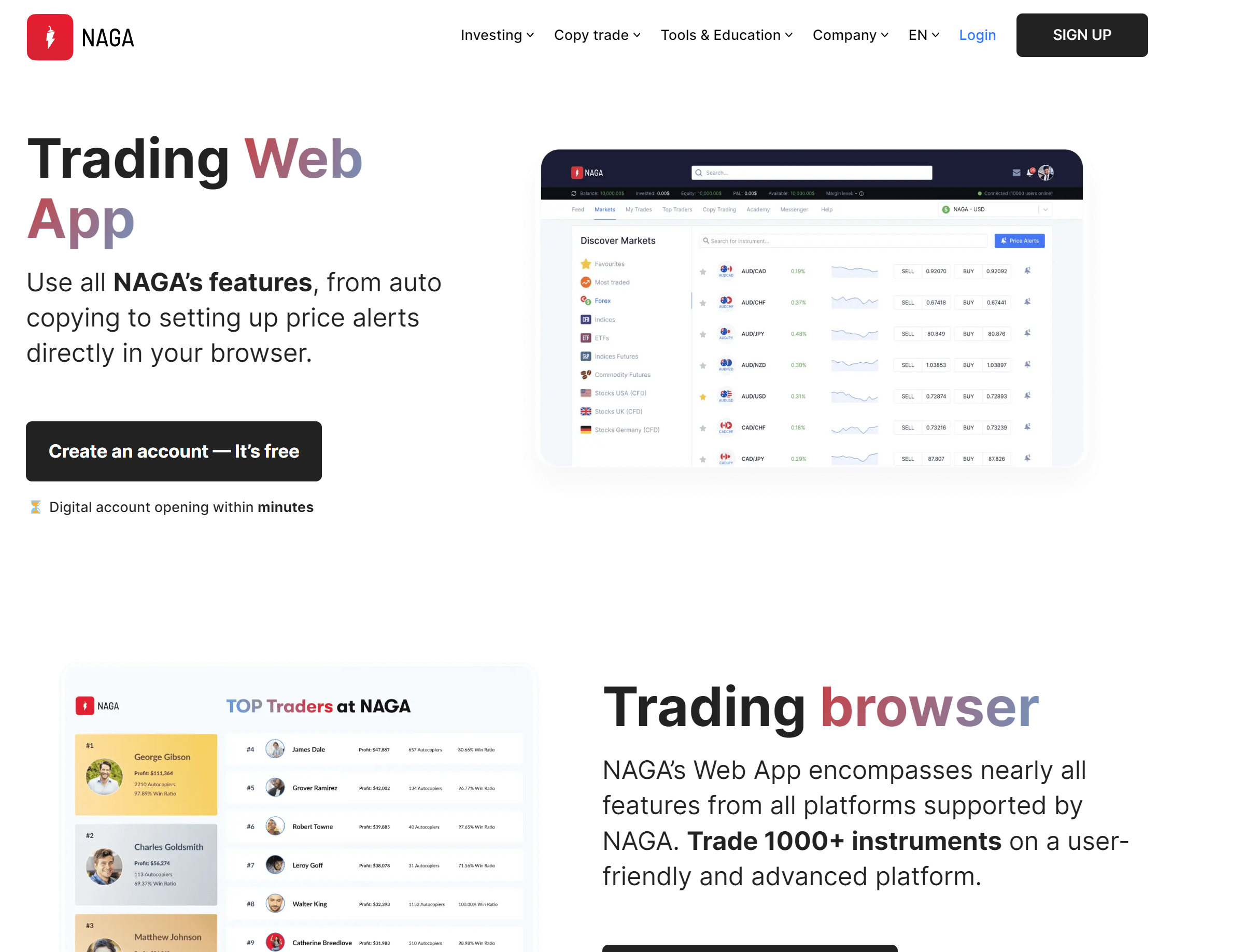

Naga presents traders with a selection of three distinct platforms, along with the Naga App, available for iOS and Android devices. Each platform boasts its own unique features, tools, and trading signals.

Among the widely acclaimed choices for both novice and seasoned traders, the globally renowned MT4 and MT5 platforms stand out. NAGA is diligently striving to stand out with its unique feature known as Copy Trading, which embodies the company’s vision of creating an online community for traders to broaden their horizons. Through this platform, traders can theoretically gather valuable trading tips and strategies from one another, fostering knowledge sharing.

| ➦ But could this community be manipulated to steer traders in the wrong direction? ➡️ Note that with Social trading communities, there is a risk of manipulation as brokers have a vested interest in encouraging certain trades or strategies that may not always align with the best interests of the traders. |

As claimed by this broker, users can take advantage of a number of main features in Naga WebTrader and the associated applications. These include the convenience of auto-copying trades, access to trading signals, and a comprehensive market news feed.

Does Naga Connect You to Opportunities Across the Globe?

Once your trading account is set up, they promise that you will be able to explore a world of financial markets. Within these markets, you could discover a range of offerings, including a diverse selection of currency pairs, CFD stocks, indices, commodities, ETFs, Real Stocks, and Futures. The vast array of options ensures that you have ample opportunities to diversify your portfolio and engage in trading activities aligned with your investment goals.

Forex Pairs | CFDs on Stocks | Indices and Futures | Real Stocks | Commodities | ETFs |

Options such as EUR/USD, EUR/GBP, as well as more exotic options such as USD/HUF are available. | Engage in speculation on the price movements of your preferred company’s shares. | Access a broader range of assets and gain exposure to various market segments through CFDs on indices and futures. | Discover an extensive collection of over 370 real stocks representing global companies. | Trade a wide variety of popular commodities, including silver, gold, crude oil, and more. | Sought-after ETFs such as Vanguard TSM, Nasdaq Biotech, SPDR DJIA and others are available. |

➟ Embracing Limitless Possibilities with a Naga Trading Account.

Do Their Trading Account Types Match Your Trading Style?

NAGA offers a range of 6 trading accounts, each with its own advantages.

The Iron account is NAGA’s basic option, requiring a $250 minimum deposit. It features standard spreads, no commissions, and a copy bonus of up to $0.12 per replicated trade. However, it does not include a PI Dashboard.

The Bronze account demands a $2,500 minimum deposit. It offers standard spreads, no commissions, and a copy bonus of up to $0.15 per replicated trade. Additionally, it comes with a PI Dashboard for analyzing trading performance.

The Silver account requires a $5,000 minimum deposit. It offers standard spreads of 1.2 pips, no commissions, and a copy trade earning of up to $0.18 per replicated trade. It includes a PI Dashboard, along with trade alerts, webinars, and five daily signals.

| ➦ Is the provision of numerous account types leading to trader confusion and escalating administrative complexity? ➡️ To mitigate these disadvantages, brokers should strike a balance between offering account diversity and maintaining simplicity. |

For a premium account, the Gold account requires a $25,000 minimum deposit. It features spreads as low as 0.9 pips, no commissions, and a copy bonus of up to $0.22 per replicated trade. It includes a PI Dashboard, 15 daily signals, trade alerts, webinars, and one-on-one tutoring sessions.

The Diamond account, with a $50,000 minimum deposit, offers spreads as low as 0.7 pips, no commissions, and a copy bonus of up to $0.27 per replicated trade. It includes a PI Dashboard, 20 daily signals, trade alerts, webinars, tutoring sessions, and premium eBooks.

Finally, the Crystal account is designed for institutional traders, requiring a $100,000 minimum deposit. It features spreads as low as 0.7 pips, no commissions, and a copy bonus of up to $0.32 per replicated trade. It includes a PI Dashboard, unlimited signals, trade alerts, webinars, tutoring sessions, and premium eBooks.

Do Their Payment Methods Align with Your Wishes?

Traders have the flexibility to choose from a diverse range of funding methods, tailored to their specific residency requirements.

For standard wire transfers, Naga accepts transactions from 30 different banks. Another convenient option is Credit/Debit Cards, provided by Visa, Mastercard, or Maestro, which typically offer instant processing times.

Additionally, there are eWallets available, including Neteller and Skrill, which offer alternative and competitive instant payment options for eligible users.

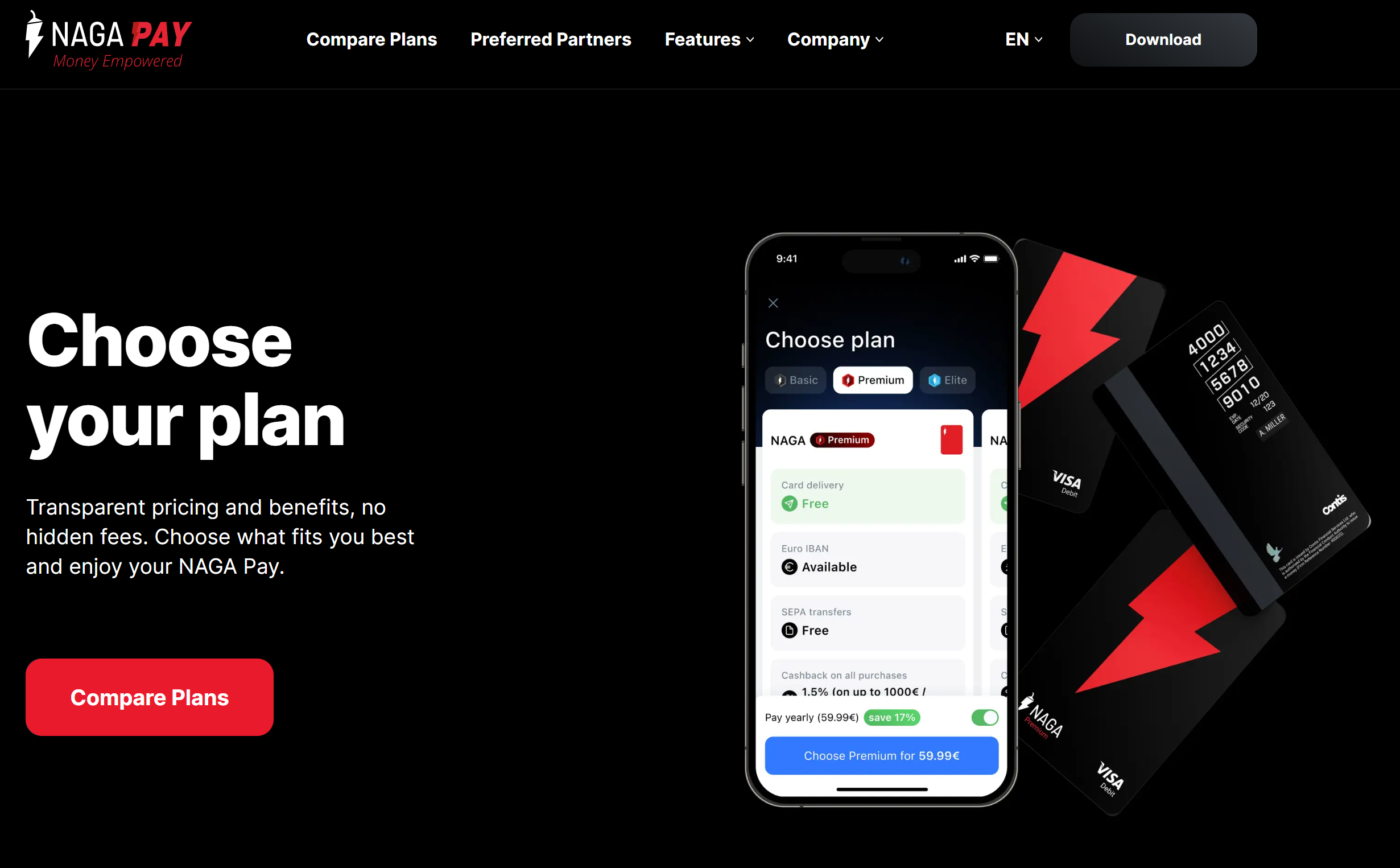

Furthermore, Naga offers its exclusive ‘NAGA Card,’ utilizing prepaid card technology.

With this NAGA Pay, you can access a wide range of convenient services that include global ATM withdrawals, international money transfers, seamless payments in local currencies, effortless utilization of your trading profits, and an array of additional benefits for your enjoyment.

How Fair Are Naga’s Fees, Spreads, and Commission Structure?

When trading with Naga, traders can expect fees starting from $1 USD, spreads ranging from 0.9 pips to 1.7 pips, and the advantage of commission-free trading, which varies based on the chosen trading account.

- Commissions on CFDs: 2.50EUR

- Commissions on Stocks: 0.99EUR

- Commissions on ETFs: 0.10% on the notional value.

- Copy Trading Fee: a fixed 0.99 fee per trade. An additional fee applies only if the profit is more than 10 EUR. For any profitable €10+ trade, a 5% fee will be charged for copying a trader’s order

Account | Iron | Bronze | Silver | Gold | Diamond | Crystal |

Min. Deposit | $250.00 | $2,500.00 | $5,000.00 | $25,000.00 | $50,000.00 | $100,000.00 |

Spreads from | Standard Spreads (e.g. EURUSD 1.7) | Standard Spreads (e.g. EURUSD 1.7) | Silver Spreads (e.g. EURUSD 1.2) | Gold Spreads (e.g. 0.9 on EURUSD) | Diamond Spreads (e.g.0.7 on EURUSD) | VIP Spreads (e.g.0.7 on EURUSD) |

Withdrawal Fees | ✅ | ✅ | ✅ | ✅ | ✅ | – |

Swap / Rollover | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

Inactivity Fees | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ |

Currency Conversion | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

Is Naga’s Customer Support in Line With Your Expectations?

Their dedicated support team is committed to offering professional assistance to all traders. Customers can conveniently reach out to the support team via phone or email, depending on their location, and benefit from multilingual services that ensure easy communication for inquiries and concerns.

Can I trust NAGA as a broker?

➦ After conducting a comprehensive investigation on NAGA, the platform’s reputation, particularly in the past year, is somewhat concerning. The signals it emits are causing some apprehension among traders. Therefore, we suggest you exercise caution if you contemplate any involvement with the platform. We invite you to share your thoughts below and assist other traders in making an informed decision on selecting the right broker for their needs.

📌 Leave Your Feedback and Let Your Voice Be Heard!

| 📩 Email us at: info@broker4all.com |

Disclaimer: The information and materials provided on this page or made available through this page (“Contents”) are sourced from third parties and should not be considered as an endorsement by (Company Name) of such Contents or the products offered by such third parties. (Company Name) has no control over the accuracy, availability, or legality of the Contents and hereby disclaims any responsibility for them. Any transactions that you undertake with any third party listed on this page or linked from this page are solely between you and such third party, and you do so at your own risk. (Company Name) assumes no liability for any damage or loss that may arise from your use of or reliance on the Contents.

Leave a Reply