Remember, your financial future depends on the choices you make today.

Website: | |

Email: | |

Telephone: | +357 22 222046 |

Company Address: |

⚠️ SCAM ❔ 👀

➡️ The ratings of the Admirals are anticipated to be absolutely captivating.

Withholding Profits & Withdrawal Delays | ⭐⭐⭐ |

Transparency | ⭐⭐⭐ |

Withdrawal Options & Terms | ⭐⭐⭐ |

Large Withdrawal Challenges | ⭐⭐ |

Trust in Services | ⭐⭐⭐ |

Support Department Response Time | ⭐⭐ |

Fees & Charges Fairness | ⭐⭐ |

Investments involve risks and are not suitable for all investors.

⛔️ Make sure to read our comprehensive review of Admirals (Admiral Markets) before you begin trading! ⛔️

Admirals is indeed a globally renowned brokerage with a long-standing presence in the trading industry spanning over 20 years. However, while the company prides itself on professionalism and a trader-centric approach, some concerning aspects warrant attention.

Despite its impressive longevity, Admirals’ reliance on solid regulations may not entirely mitigate potential risks for traders. While Admiral Markets UK Ltd is licensed by the Financial Conduct Authority (FCA) and authorised to hold Client Money, concerns arise regarding its White Label provider, Admiral Markets AS Jordan Ltd. While being a sister company, Admiral Markets AS is regulated by the Jordan Securities Commission (JSC), which may not offer the same level of oversight and protection as other regulatory bodies.

Regulators of the Admirals group of companies include FCA (UK, 595450), CySEC (Cyprus, 201/13), ASIC (Australia, 410681), JSC (Jordan, 57026), and CIPC(South Africa, 2019 / 620981 / 07).

| ➦ Did you know that Admiral Markets AS has been fined 32,000 euros by the Estonian Financial Supervision and Resolution Authority for breaching its legal obligations in providing investment services? BE CAREFUL OUT THERE! Also, read: • The Financial Supervision Authority prohibited Admiral Markets AS from providing services via a branch established in the Czech Republic. • Estonia’s top financial markets supervisor has fined FX brokerage firm Admiral Markets AS €20,000 for failures in its regulatory reporting governance. • In 2023, Admiral Markets AS withdrew the investment company license granted to them in Estonia. |

➡️ Did you know that brokers make some extra cash by charging traders a small fee for holding positions overnight? This fee is based on the difference in interest rates between the currencies or assets being traded. It helps brokers earn money and manage the risks of providing leveraged trading services. These risks can be pretty high, especially during volatile market conditions – but by charging overnight fees, brokers can mitigate them.

➦ Are you curious about the Contract Specifications and overnight costs charged by Admirals? Check it out here!

Exploring the Upsides and Downsides of Opting for Admirals

Pros: | Cons: |

✅ Thousands of CFDs to Trade | ❌ Do not accept clients from the USA |

✅ Multilingual Customer Support | ❌ Charges a monthly inactivity fee |

✅ Swap-Free Islamic Account Available | ❌Currency conversion fee is charged |

Does the Admiral’s platform have what you need?

While Admirals presents traders with enticing options like MetaTrader 5, a platform favoured by traders worldwide, there are aspects that raise concerns. Although MetaTrader 5 offers many advanced charting and trading tools, along with automated trading features, traders must be wary of potential complexities and risks associated with trading various assets.

➡️ Although MetaTrader 5 is supported by the platform, there are limitations to 100 lots.

Additionally, while Admirals also offers MetaTrader 4, boasting a fast and responsive trading infrastructure, traders should remain vigilant about potential technical glitches or system downtimes that could disrupt trading activities.

Moreover, while the MetaTrader WebTrader may seem convenient for traders hesitant to install platforms on their devices, relying solely on web-based trading may expose traders to cybersecurity risks and limitations in functionality.

| ⚠️ How reliable is the Admirals Mobile App? ➡️Setting price alerts in the Admirals (Admiral Markets) app is impossible. Therefore, the absence of price alert functionality in the Admirals app could be a significant drawback for traders who rely on this feature for their trading strategies. |

Is Admiral truly providing you with access to global opportunities?

While Admirals prides itself on offering traders a diverse range of financial products across various asset classes, there are certain aspects that raise concerns about the breadth of its offerings. While the platform boasts CFDs in cryptocurrencies, indices, shares, bonds, commodities, and currency pairs, traders must approach this diversity cautiously. Despite the appeal of having access to multiple asset classes, traders should be aware of the inherent risks associated with trading each type of instrument.

Additionally, while Admirals provides access to over 40 CFDs on currency pairs, traders should exercise caution when trading Forex, as volatility and market dynamics can pose significant challenges. Similarly, while commodities, cryptocurrencies, stocks, indices, and bonds may offer unique trading opportunities, traders must carefully assess their risk tolerance and investment objectives before diversifying their portfolio across multiple asset classes.

➦ Explore the Account Options provided by Admirals!

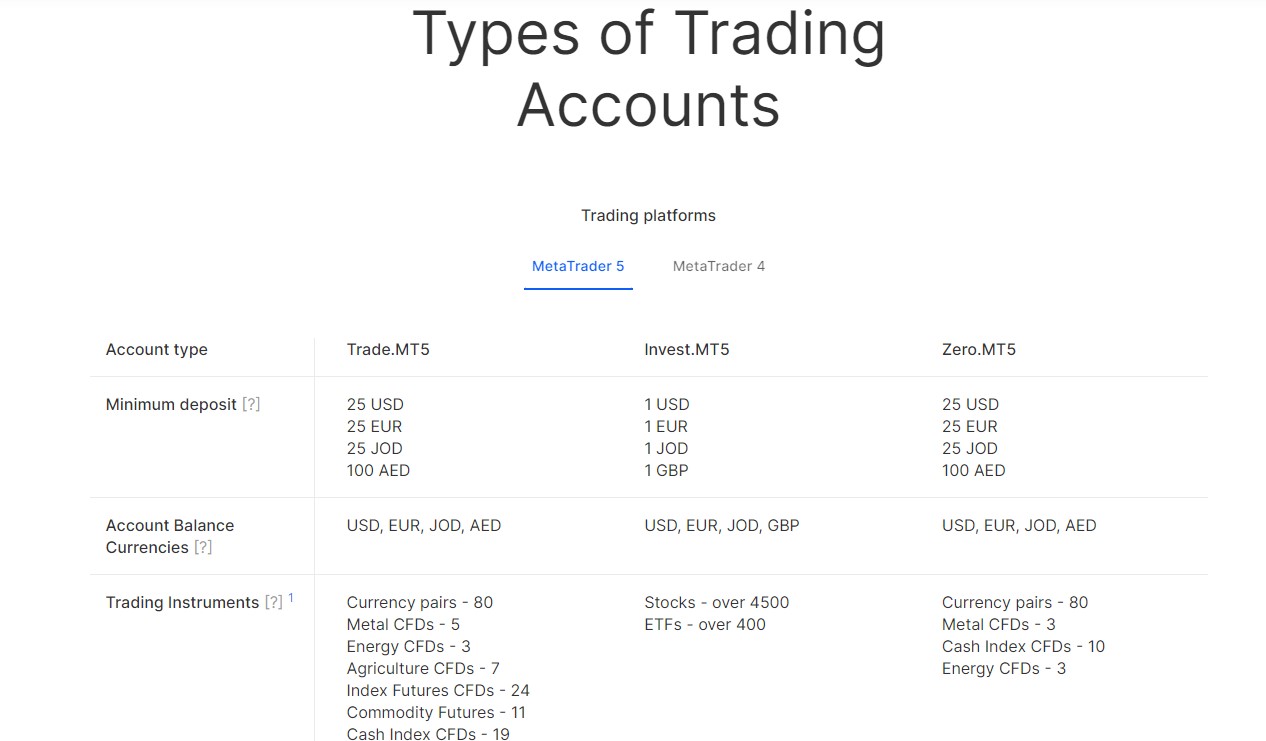

While Admirals presents a range of trading account types tailored to traders’ individual needs and objectives, there are certain aspects that may raise concerns for prospective traders. While the availability of five different trading account types offers flexibility, traders must carefully evaluate the features and limitations of each account before making a decision.

Admirals differentiate account types based on the trading platform, such as MetaTrader 5 or MetaTrader 4, each offering a distinct set of features and resources. However, traders should be cautious about the complexities of managing multiple accounts and navigating between different platforms.

Admirals categorise their account types based on the trading platform. For MetaTrader 5 users, there are three distinct account options available: Trade.MT5, Invest.MT5, and Zero.MT5. Each account type varies regarding the minimum deposit requirement, the range of tradable instruments, and access to trading tools and resources. Alternatively, for traders who opt for MetaTrader 4, Admirals offers two account choices: Trade.MT4 and Zero.MT4, each featuring unique financial products and spread types tailored to meet diverse trading preferences.

Is the Admiral totally on board with meeting regulatory standards?

While Admirals presents itself as a trusted brokerage committed to regulatory compliance, there are certain aspects that may give cause for concern. While the firm boasts licenses from well-known financial regulatory bodies such as the FCA in the UK, CySEC in Cyprus, the AFSL in Australia, the JSC in Jordan, and the FSCA, traders should remain vigilant about potential gaps in oversight or enforcement by these regulatory authorities.

Despite Admirals’ claims of prioritising client interests, the effectiveness of segregating client funds and implementing advanced security measures remains uncertain. Traders should approach Admirals’ assurances with caution and conduct thorough due diligence to ensure the safety and reliability of their investments.

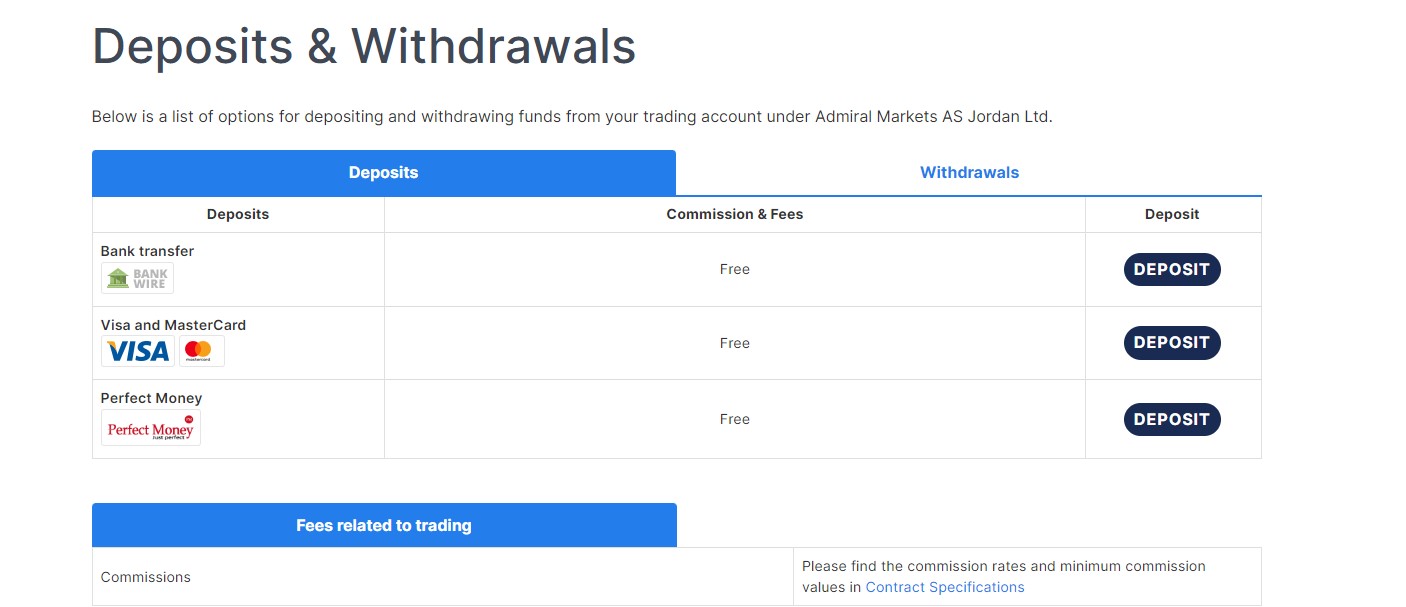

Examining Admiral’s Payment Methods

Admiral offers a range of deposit options and efficient withdrawal processes, enabling traders to carry out transactions smoothly and manage their funds with ease on a daily basis.

➦ Reaching Out to the Admirals Support Team

At Admirals, their customer service team is here to make sure every trader gets the help they need. They prioritise providing expert support, and their multilingual services make it easy for clients to reach out. Whether you prefer giving them a call or sending an email, they got you covered, no matter where you’re trading from.

Can Admiral’s trading platform be trusted, or is it a bit shady?

When it comes to choosing a broker, it’s essential to do your research to make the right call. Admirals is a well-known name in the trading world, but despite its reputation and services, some doubts linger about its reliability. It’s wise to proceed cautiously before jumping in. We’d love to hear your thoughts and experiences in the comments below, helping out other traders in the process. Just be aware there’s quite a buzz of negative reviews out there about Admiral Markets, so keep that in mind.

📌 Leave Your Feedback and Let Your Voice Be Heard!

| 📩 Email us at: info@broker4all.com |

Disclaimer: The information and materials provided on this page or made available through this page (“Contents”) are sourced from third parties and should not be considered as an endorsement by (Company Name) of such Contents or the products offered by such third parties. (Company Name) has no control over the accuracy, availability, or legality of the Contents and hereby disclaims any responsibility for them. Any transactions that you undertake with any third party listed on this page or linked from this page are solely between you and such third party, and you do so at your own risk. (Company Name) assumes no liability for any damage or loss that may arise from your use of or reliance on the Contents.

Leave a Reply